Inflation

Tuesday, Sept 13, the Commerce Dept. Bureau of Labor Statistics will release the August Consumer Price Index an hour before the markets open. Last week I reported that with crude oil prices and wholesale gasoline prices declining in August, I expected inflation to come in between 8.3% - 8.7%.

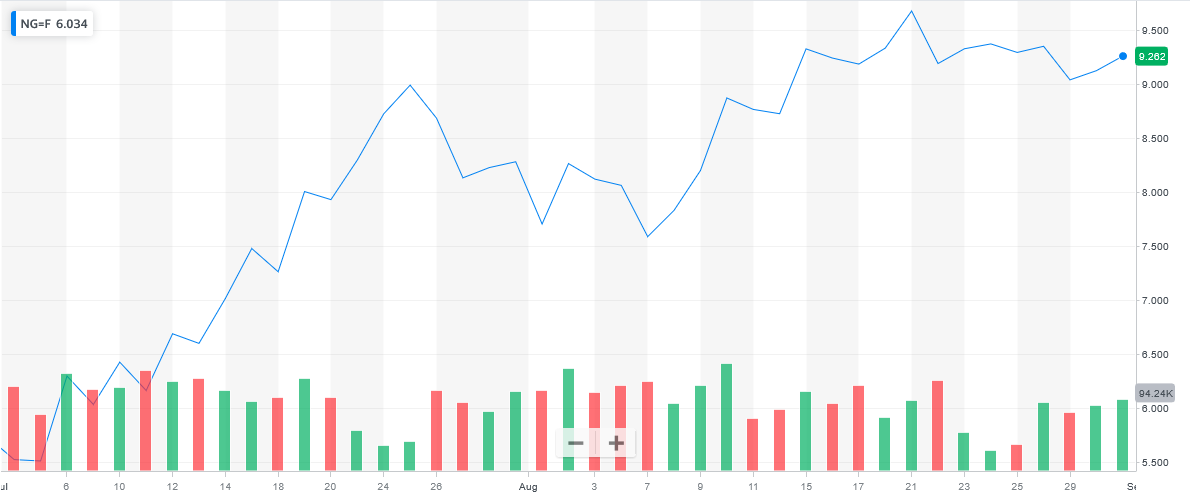

The one thing I think that can surprise many of us is natural gas. Natgas was up 43% in July and an additional 10.9% in August., from closing at $5.42 on June 30th to $9.28 August 31st.

Compounded, that is a whopping 71.2% increase in the past 2 months.

Natural Gas

Most of us think about natural gas as being used for cooking and heating. The reality is that it is used in an amazing number of products and processes.

About 34% of electrical power in the U.S. is from natgas. Less obvious is that natgas is used to make literally thousands of different products. In many cases, it is used to melt, dry, bake, or glaze products or parts of products.

Natural gas is an ingredient used to make fertilizer, antifreeze, plastics, pharmaceuticals and fabrics. It is also used to manufacture a wide range of chemicals such as ammonia, methanol, butane, ethane, propane, and acetic acid.

About 21% of natgas is used directly in our homes. Besides cooking and heating, it is also used for our clothes dryers, water heaters, bbq’s, and some lighting and air conditioning.

With 34% of natgas used in power generation and 21% in home usage, that leaves nearly half of natgas (45%) used for industrial and commercial usage.

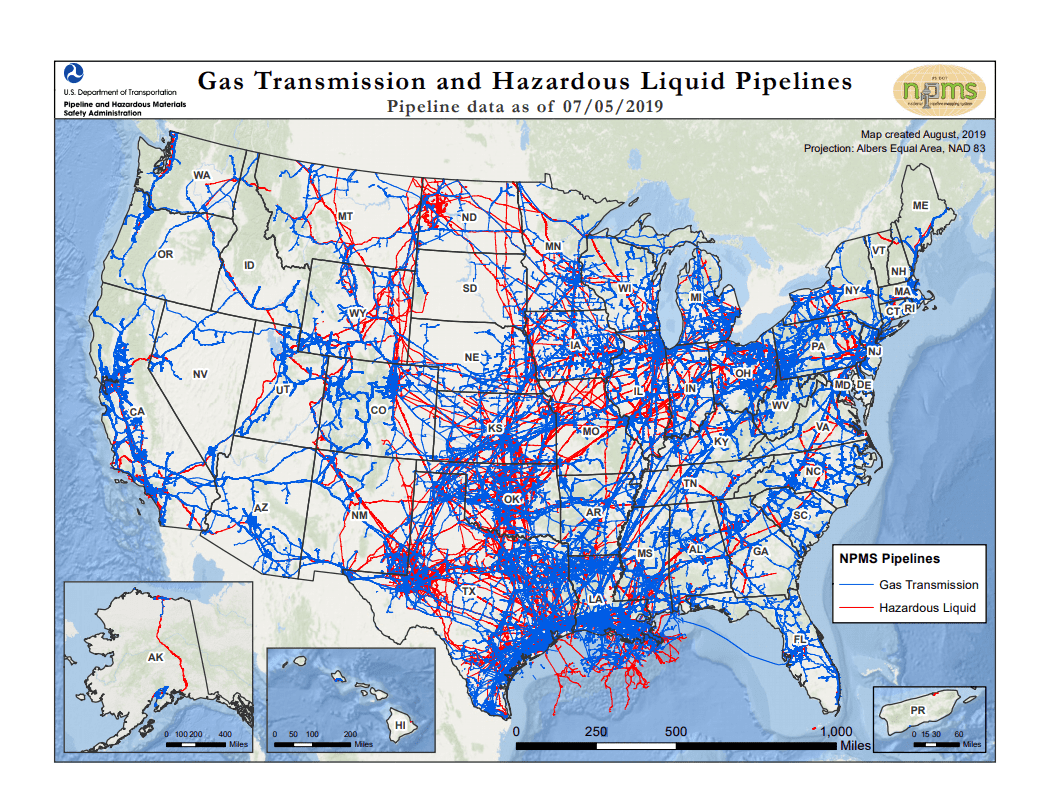

This is a map of the U.S. natgas pipelines.

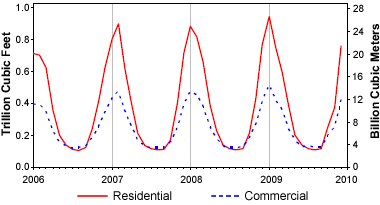

The summer usage of natgas is much lower than winter usage. This recent 71% increase occurred during low season. Winter usage is about 6x higher than summer because of widespread use of natgas for heating homes, industrial and commercial properties. See the peaks and valleys? The peaks are winter demand, the valleys are summer demand. It’s all about outside temperatures.

Now add in the Russians retaliating against the Europeans for the sanctions. With Europe now groping for replacement supplies, we could see inflation going through the roof this winter. Europe is already shutting down some industries in order to build their storage of gas for winter heating. Their priority, naturally, is to provide heat rather than use gas for industrial purposes.

This will severely impact the supply chains from Europe.

If natgas went up 71% in low season, what will it do this winter? It has Europe freaking out. With good reason.

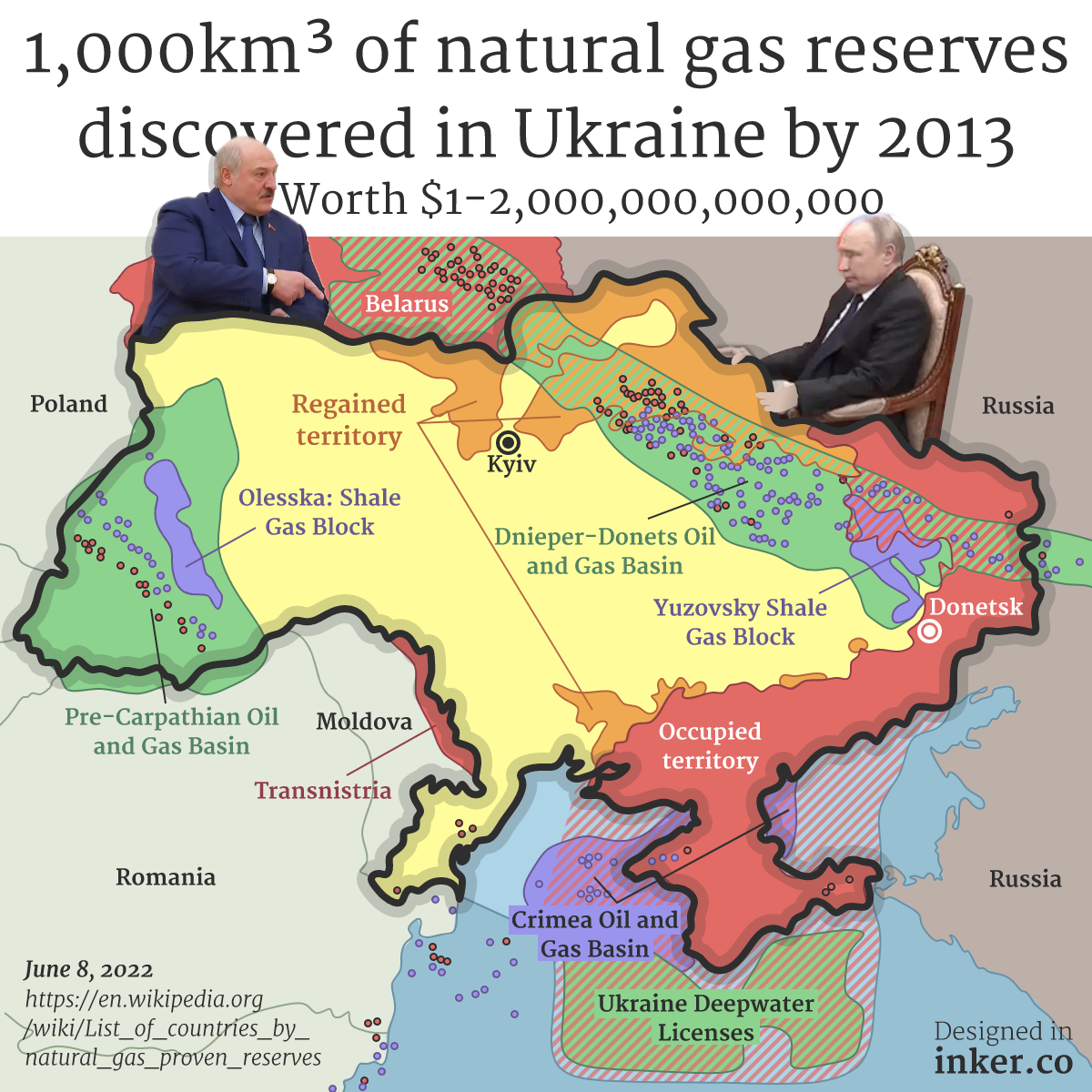

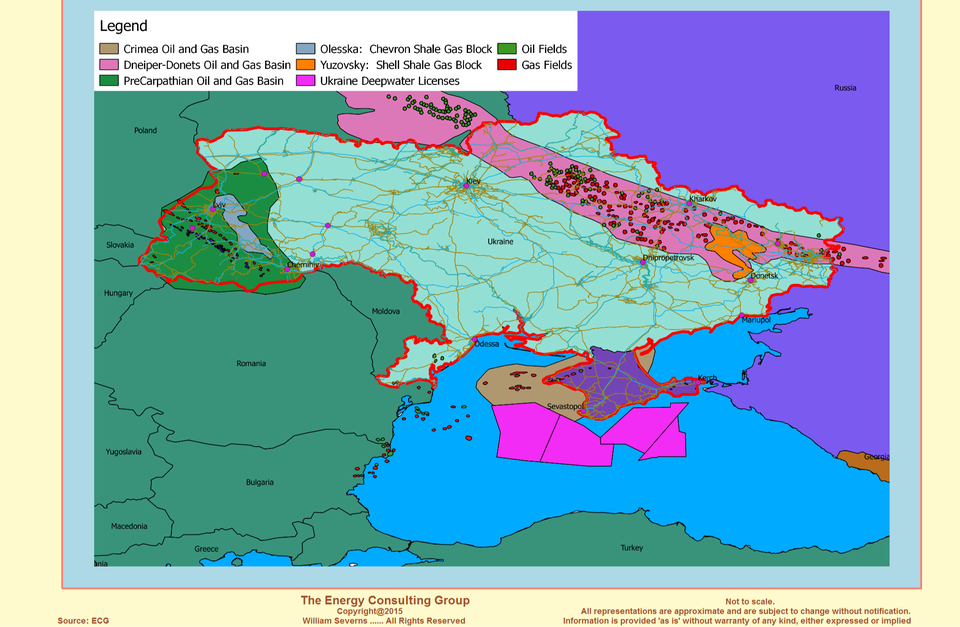

The war in Ukraine is all about energy and natural gas in particular. Here is a map of Ukraine natgas reserves.

There are 3 main O&G fields

1. Dnieper-Donetsk-Yuzovsky,

2. Crimea O&G Basin and Black Sea Deepwater, and

3. Olesska and Pre-Carpathian O&G Basin.

Only #3. Olesska and Pre-Carpathian O&G Basin is not in the Russian invasion territory.

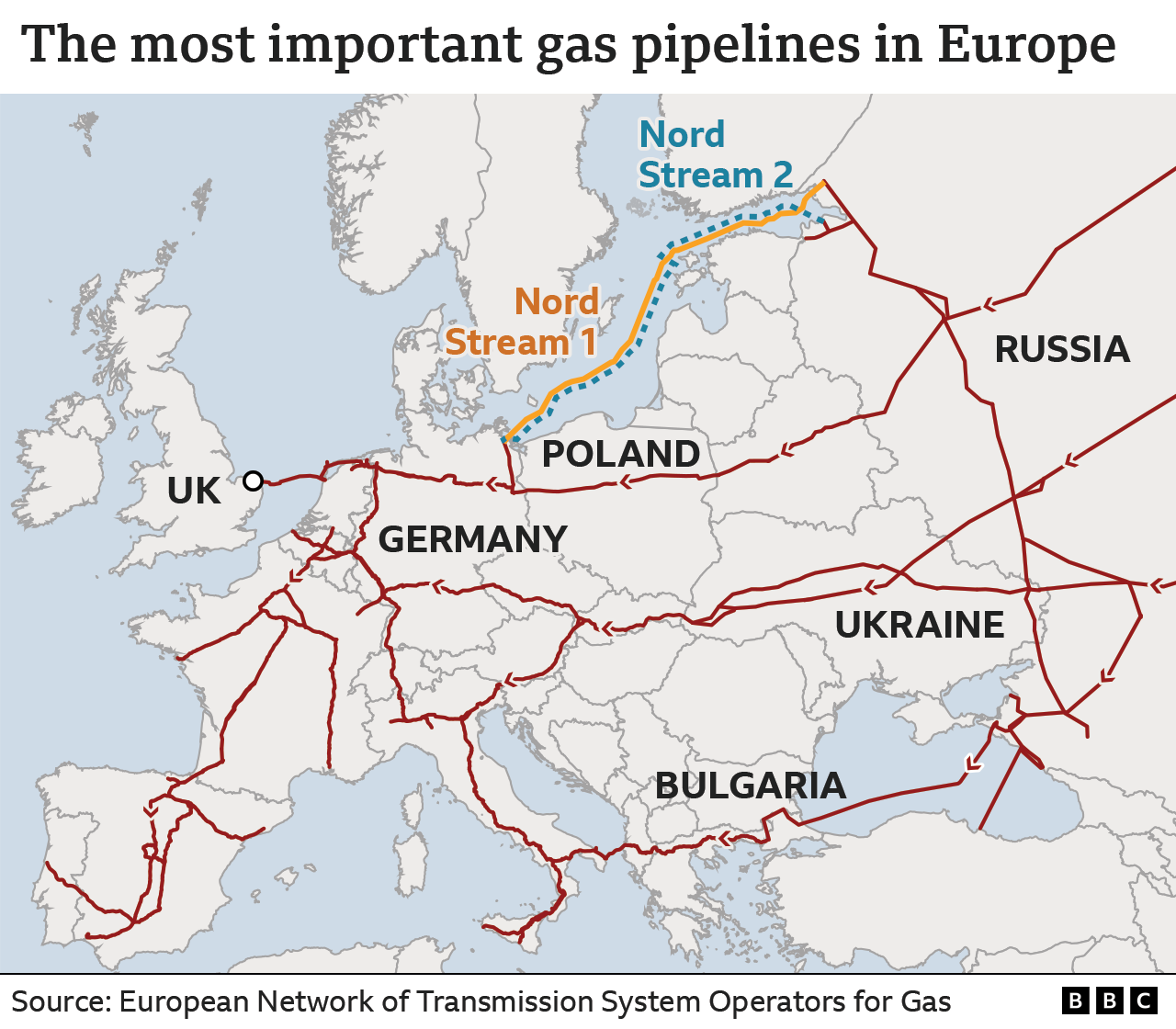

Here is a map of Russian oil & gas pipelines into Europe.

The Crimea takeover in 2013 and the current invasion are all about energy and Russia’s intent to dominate supplying Europe with it. The largest Ukraine reserves are offshore Crimea and the Dnieper-Donetsk oil & gas fields. Notice where the Russian occupied territories are on the upper map. That is where the initial Russian invasion was focused. The news media said it was about taking control of the government by taking Kiev.

Nope, it was all about that $trillion Dnieper-Donetsk O & G field in eastern Ukraine and the Olesska shale gas on the western Ukraine boder.

It is also about weakening the U.S. stranglehold on being the reserve currency of the world.

In the early 1970’s, President Nixon made a deal with the Saudi’s. In exchange for the U.S. providing a military security umbrella for Saudi Arabia, the Saudi’s and OPEC agreed that all oil & gas globally must be traded in U.S. dollars.

This was essentially an interest free loan to the U.S. At $85/barrel and 80 million barrels/day being used globally, that’s about $6.5 billion/day or $2.5 trillion a year. It was a brilliant move by Nixon. Tricky Dick he was.

Russia is now breaking with this OPEC policy of trading only in dollars since Biden spearheaded the sanctions. Since the Russians produce roughly 25% of global oil & gas, the Russians are now demanding payment in rubles for their O & G. That’s about $600 billion of interest free loans annually the U.S. has lost to Russia. It’s also the reason the ruble has been the currency leading the world in strength this year. It’s not the dollar, even though it’s also been strong this year.

In effect, we are financing Russia’s invasion. He might not be happy with how the war is progressing, but Putin is laughing at Joe all the way to the bank, and back.

Shale Gas

The Ukrainian oil & gas fields include a huge amount of shale gas. Want to make an investment on Europe financing and backing the Ukrainians since they are so desperate for energy?

Buy the best companies in the business of horizontal drilling, oil services and fracking shale globally. If Europe wants the job done right and quickly, it has to be

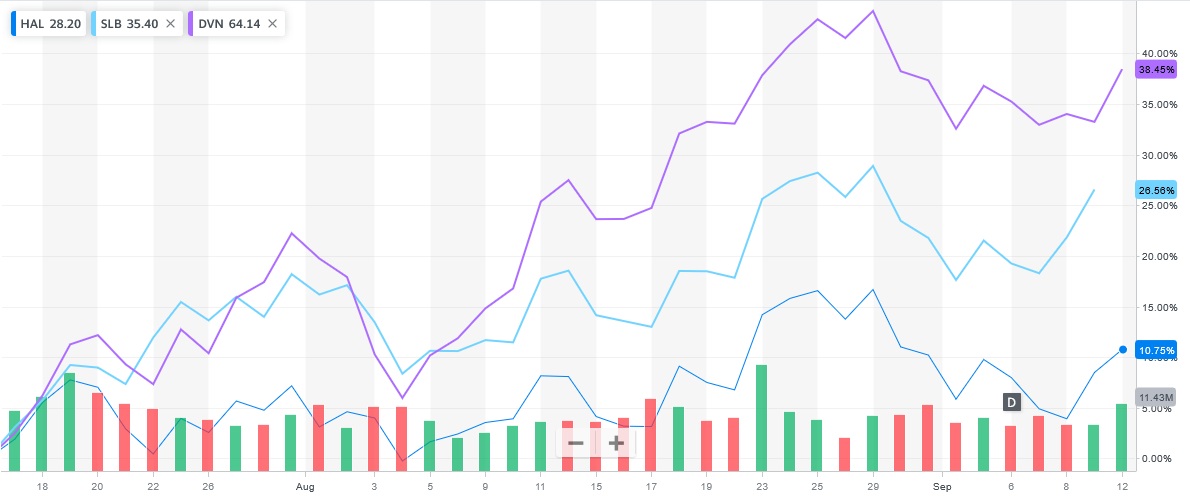

Schlumberger (SLB $40.15) and Haliburton (HAL $30.28) and Devon ( DVN $64)

There are no substantial Euro competitors except perhaps the Norwegians, and they are focused on building out and expanding their North Sea complex and pipelines. The Europeans don’t have the fracking expertise since they shunned doing it.

The western Ukraine fields are not really in war danger from Russia at this time, and they are sufficiently huge to be able to replace a lot of the Russian gas over the next few years. Nearby pipelines are already there. Of the 4 major Russian pipelines supplying Europe, 2 go through Ukraine’s oil & gas fields.

HAL and SLB have the capability to bring 100-200 wells online in less than a year. I have personally witnessed them doing more than that in West Texas and New Mexico within the past 5 years. The RD Shell and BP wells in Texas used HAL and SLB. I worked on some of them. They definitely have that level of capability and capacity, as well as lots of equipment nearby in the middle east to get started.

BP, Total, and Royal Dutch Shell would be good bets too, but none has the horizontal drilling, fracking capabilities and experience like HAL and SLB. Devon Energy is primarily a huge US gas producer.

I think this is already underway, but sort of on the quiet side. Just look at their charts since the July lows.

Europe is going to move mountains to get the energy they require to keep warm and stay in business. They are going to do whatever is necessary to get those Ukrainian gas reserves flowing. It’s their best bet to secure their economies. Nobody else is closer who has those volumes of gas reserves, Then, add in the fact that the 2 big distribution pipelines are already in place nearby. That saves years.

Ukraine needs the money to finance the war and EPA-type approvals will not be required. It’s a slam dunk this is what the Europeans will do, or have already started doing. It just makes more sense than any other possible solution, and the Europeans, who disdained fracking, won’t really care if it happens in Ukraine. An inconvenience they can easily overlook if they are warmer in winter and their businesses keeping people employed.

HAL and SLB could drop in 10 teams to create well pads and roads to them, 10-15 drilling teams, 20 fracking teams, and 10-15 finishing teams and they would be bringing 4 or 5 new wells online each week in a matter of a few months. They could probably double that pace in 6-12 months.

It’s the fracking teams that will be the limiter. Each frac team needs 16 trucks with monster 3000+ horsepower diesels linked together to produce the 50,000 hp needed for fracking pressures required 24/7 for 2 weeks +/- to do 3 wells (150-500 fracking stages) on a single pad. Then add in the 200 or so loads of sand (50,000 lbs each) and the trucks delivering fuel and water to keep them all running 24/7. I have seen some wells using 4 loads of sand (25 tons/load) each hour. That’s a lot of truckloads each week.

Not to mention the trucks delivering 2-3 miles of pipe to the drilling teams for each well (3 wells to a pad.) Nine miles of 8”-15”pipe in lengths under 40’ is a lot of truckloads of pipe for the drilling teams. And don’t forget, you also need not only natgas pipelines but butane, propane, methane, and oil pipelines from the separators at the wellhead to the main distribution pipelines. And water pipelines too.

You can’t just line them up and do consecutive pads either. Then too many trucks are needing the same roads to access the wells. They have to be co-ordinated over a large area so that the traffic is manageable to at least some degree. Keep in mind the heavy equipment for making roads, digging pipelines, leveling pads, drilling, storage tanks, and finishing etc. all have to move every week or two to another well pad.

Then add in the fact the workers need sleeping quarters, showers and restrooms, laundry, food and fuel and maintenance services nearby.

Where are the steel pipes coming from? Germany? Poland? The sand? Turkey? Greece? It has to be sifted and uniform, and chemically correct for the geology.

HAL and SLB have been doing it all for many years. It’s a specialty and logistics are a big part of it.

Yes, they have a big job ahead. Major.

Better bring in HAL and SLB. They have already done it all over the world.

They can make it happen, and pretty fast too.

Please keep in mind these are ballpark figures. They can vary by a lot depending on the geology and topography involved, and I am not familiar with what Ukraine has to work with. I do know Ukraines’ steel and pipeline mills are in the Donbass region occupied by Russia and are already mostly destroyed.

That represents opportunity for Poland, Germany, Czech Republic, Slovakia etc.

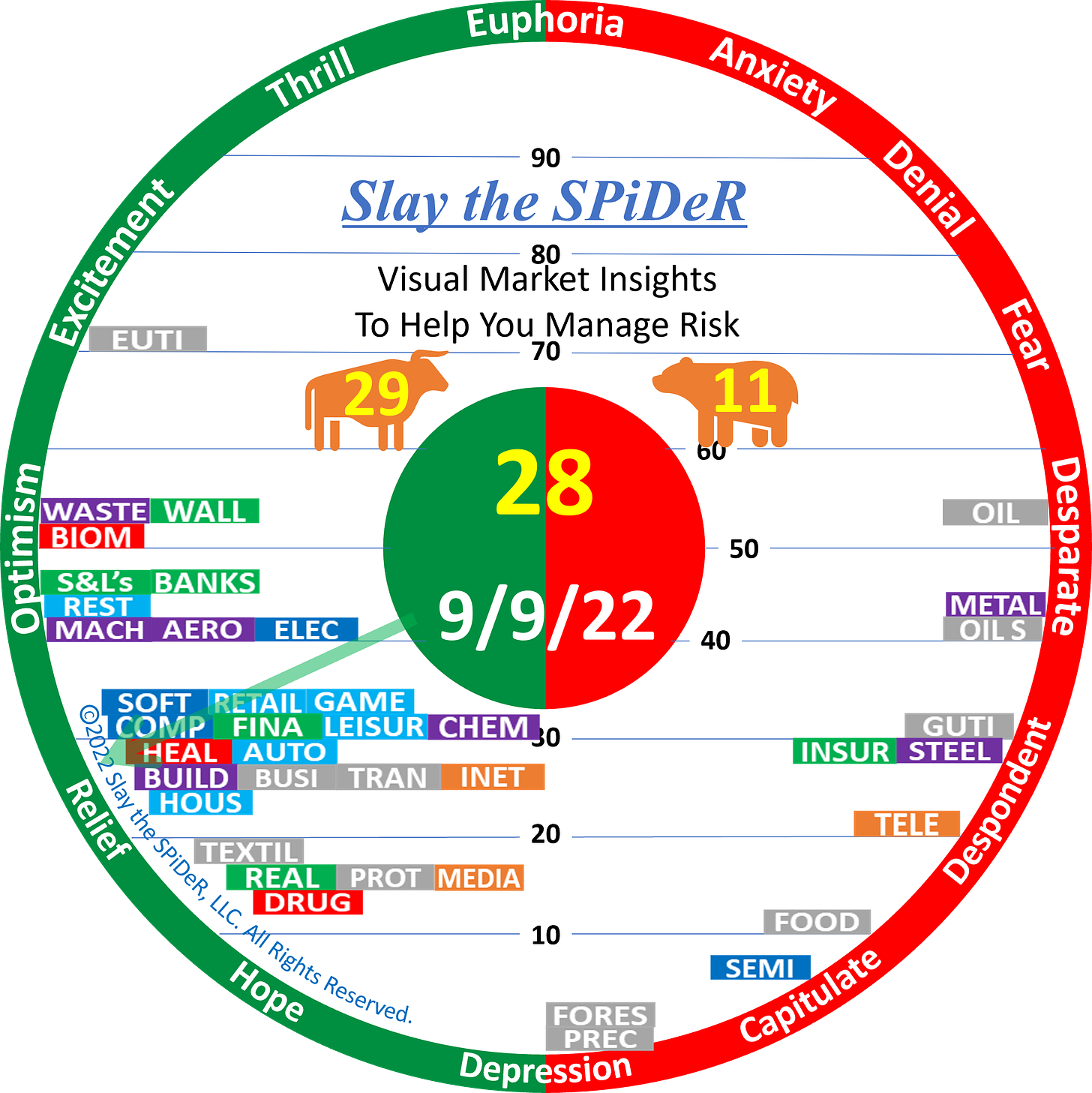

Charts and Video

Video

Fed Meeting Sept 20-21

Next week the Fed FOMC meets to raise rates again. I’m guessing a 75 bps rate hike on the 21st by the Fed.

Let’s Go Get the Money

or at least keep what we have.

The rally that started last Wednesday is going to end this week, perhaps Tuesday.