Zombie Companies

What are they? They are companies with lots of debt, so much that their earnings do not even cover interest payments on their debt. Now it’s going to get harder for them because as interest rates rise, so do their debt payments.

Lots of companies piled on the debt during the pandemic. Rates were low, so it was cheap easy money. When I say lots of companies, I am serious. Over 20% of the largest 3000 companies (in terms of market cap) are not making enough to service their debt, so they are in a slow death spiral of spending that money on interest payments. It’s not going to change soon, as inflation is going to be with us for quite a while.

The most damaging thing is that for most of these companies, the window to borrow more has closed. Junk bond issuance in May was the lowest since 2002, a 20-yr low, with less than $2 billion in new loans. To give you an idea of what is happening, half of that, $1 billion, was a loan to Carnival Cruise Lines on a 10.5% eight year note. Just 7 months ago CCL borrowed $2 billion at 6%. Most of the 650 Zombie companies have already had the window closed to borrow more. As recently as January, they borrowed $23 billion, and over $40 billion last September.

The era of cheap easy money is now over thanks to inflation.

There are some pretty big names on that list of 650 companies. American Airlines, Boeing, and Mattel to name just three. Sadly, we’re going to be hearing of substantial layoffs from many of these companies as they tighten their belts to conserve cash in order to stay in business. I don’t expect many of them to go bankrupt quickly and soon, but it’s going to be painful for a number of them, and many of their employee’s.

Here is a link if you wish to read more about this:

https://www.bloomberg.com/news/articles/2022-05-31/america-s-zombie-firms-face-slow-death-as-easy-credit-era-ends

The Markets

We’re in a lull now that the 4 O’clock Loop has happened and the S&P broke the -20% mark a couple of weeks ago. It’s rallied up about 7.5% from the low near S&P 3810. I am expecting a little more of this rally, but not a whole lot.

For the next several weeks, we will mostly go sideways, but with some swift moves up and down in a range bound market. A swing traders dream market. That could change sooner if 1) the inflation numbers are much different than expectations for the CPI (Consumer Price Index) and PPI (Producer Price Index), or 2) the Fed raises rates more than 1/2 a point at the next FOMC meeting next week. That would be a real shocker from a Fed that prides itself on transparency.

Barring either of those 2 events happening, then we’ll be on hold until the Q2/22 earnings season begins shortly after the July 4th holiday. In late July, there will be another FOMC meeting with another 1/2 point rate hike currently expected.

If the Q2 GDP falters, we’ll officially be in a recession in July. Right now, on the Fed GDP projection tracker, the economy is expected to rise 1.7% in Q2. However, it should be noted that just a week ago, June 1st, the Fed was anticipating Q2 GDP growth of 2.4%. It’s probably going to be a very close call by month-end as to whether it is officially a recession or not.

The big surpise this past week was retailers reporting inventory builds much higher than expected. Goods are going on sale to spur sales. Also, containers coming into the West Coast ports are dropping rapidly, down 41% from earlier this year. I’m not sure if that is due to order cancellations or the inability of Chinese shippers due to covid lockdowns, but recent collapses of container shipping rates combined with inventory builds indicate that consumers are tightening their spending due to inflation. Retailers are responding to that drop in demand.

This week’s video:

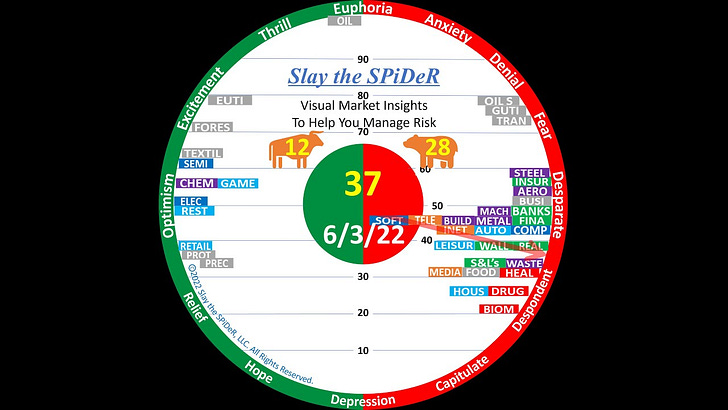

This week’s chart:

Inflation

It just baffles me to understand how after inflation began a sharp ascent in March of 2021 due to rising energy costs and big minimum wage hikes, and then the Great Resignation of job-hopping to get higher wages, that the administration, the Treasury Secretary, and the Fed could claim inflation was only temporary. Perhaps energy cost could be temporary, but certainly not if they were and still are refusing permits to increase domestic production and distribution. Those facts don’t add up at all. Wage hikes are not temporary. Intentionally raising oil and gas prices and refusing to address the issue is not temporary, especially since the goal was to fight climate change. The result has increased carbon emissions in order to ship the energy we need. Now it’s getting even worse because Europe needs to import LNG from the US to replace Russian gas.

Biden made a commitment to Europe to supply that LNG to Europe, but the administration has not issued permits to enable it to happen. The Europeans are going to hate us next winter for that when they are freezing their butts off. It’s just insane that people who claim empathy is their lifestyle driving force would do such a thing intentionally.

Sorry….pet peeve getting out here.

P/E Compression

The number of companies with high P/E’s has changed very little this past week. I’ll keep an eye on it and let you know how that is progressing.

I am hearing analysts on the financial channels that the P/E compression is finished, or nearly finished. I quite frankly don’t buy it. In both the Dot-com era and the Financial Crisis I watched P/E’s go below fair value as the pendulum swung past it to a bottom. I don’t see any reason this time will be different, particularly since we have yet to see adequate response to 8.5% inflation from the Fed. It’s going to be a long, hard slog to get entrenched inflation wrung out of the global economy.

Let’s Go Get the Money

or at least keep what we have.

JimB